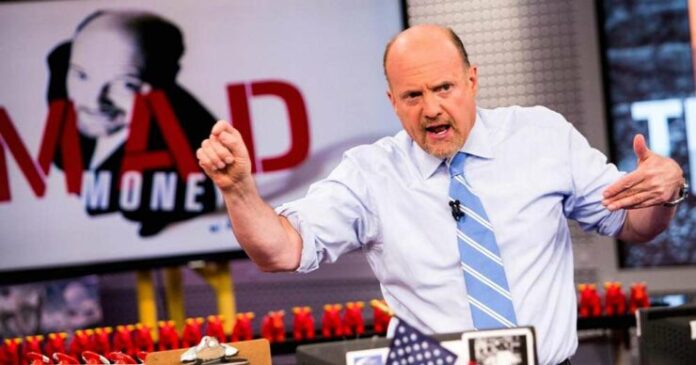

In our last post on this subject, we had asked our audience whether they would go long on Ethereum given that CNBC’s Jim Cramer – a veritable alpha-generating oracle provided that you flip his recommendations – had just turned bearish. Well, if you’d followed through, you would now be up over 40 percent!

As a refresher, Cramer had pegged a $3,000 target on Ethereum back in June, almost perfectly coinciding with the contagion in the Decentralized Finance (DeFi) space sparked by the collapse of Terra’s stablecoin. This led to a collapse in Ethereum’s price to below the psychologically important $1,000 level. Then, on the 05th of July, just as Ethereum was preparing to undergo a major test for the upcoming merge event, Cramer had turned bearish on the entire crypto sector, including Ethereum.

"Crypto really does seem to be imploding. Went from $3 trillion to $1 trillion. Why should it stop at $1 trillion? There's no real value there," says @jimcramer on #crypto. "What an awful asset. NFTs sold to you. Made up." pic.twitter.com/09e5ST8q0N

— Squawk Box (@SquawkCNBC) July 5, 2022

Well, since the 05th of July, Ethereum is up 41.88 percent or $451. The chart below illustrates this nascent rally.

As we had noted previously, the Ethereum mainnet is now slated to become a shard on the Beacon Chain as a part of the Ethereum 2.0 overhaul, thereby completing the cryptocurrency’s transition to a Proof-of-Stake (PoS) transaction authentication mechanism, which would drastically reduce the cryptocurrency’s energy footprint and attract additional capital from ESG-related inflows. This “merge” event is currently slated for Q3 2022.

As a part of this process, Ethereum continues to undergo important testing. For instance, in early July, the cryptocurrency conducted its second-to-last merge test, dubbed Sepolia.

Thanks to everyone who watched the Sepolia merge livestream!!

The Sepolia merge transition went through successfully (and the chain finalized!) so now it's time for monitoring over the next few days.

Then we merge Goerli...

...then mainnet

The Merge is coming

— sassal.eth

(@sassal0x) July 6, 2022

The milestone did come with minor hiccups, as between 25 and 30 percent of the validators were forced to go offline following the merge test due to “wrong configs.” Nonetheless, the issue was promptly rectified. Ethereum’s last merge test, dubbed Goerli, is now scheduled to take place within the next few weeks. Following this test, Ethereum will officially transition to a PoS authentication mechanism by October 2022.

In our last post, we had noted the risks associated with going bearish on Ethereum just ahead of the highly anticipated merge event, as was the case with Cramer’s bearish call. Nonetheless, readers should note that the entire cryptocurrency sector is not out of the proverbial woods, with a final capitulation yet to play out. Ethereum, however, should continue to benefit from the merge event hype in the interim.

Correction: he actually last rang it on March 6th, 2020.

It was red end of the day then, too, closing down 2%.

Ten days later the market crashed completely due to covid. https://t.co/fnsl1hfWwY

— unusual_whales (@unusual_whales) July 18, 2022

On a side note, Cramer had rung the opening bell on the New York Stock Exchange yesterday. Predictably, the market ended the day in red, hammered by Apple’s decision to slow down hiring.

The post Cramer Curse Works Like a Charm: Ethereum Is Now up Over 40 Percent Since the Day Jim Cramer Turned Bearish by Rohail Saleem appeared first on Wccftech.

WccftechContinue reading/original-link]