The Taiwan Semiconductor Manufacturing Company (TSMC) is unlikely to further change its revenue forecasts for this year due to recent shifts in the semiconductor industry believes an analyst. TSMC, along with other chip firms, has been struggling with a weak market plagued by glut as orders from chip customers drop due to excessive inveontry. However, according to a Taiwanese analyst, new product launches in the smartphone industry and the end of inventory correction in the personal computing segment should provide relief to TSMC as the third quarter nears its end and the firm's earnings results for it are due next month.

Stability In the Personal Computing Market & New Smartphone Launches Should Make TSMC Avoid Another Guidance Revision

TSMC's earnings report and analyst call for the second quarter were marked for a pessimistic tone that saw management warn that the inventory correction cycle in the semiconductor industry might take longer than expected. Subsequently, the firm reduced its revenue guidance for the full year, marking the second time it had done so.

After the revision, rumors started to surface that TSMC might revise the guidance once again, and worried about the implications of these rumors on the share price, TSMC was quick to issue a clarification. Now, as September enters its final week, more insight into the PC market and fresh smartphone launches by Apple have led one analyst to conclude that not only will TSMC not revise the revenue guidance for a third time, but that its revenue should also improve next year.

The reason behind this is that, according to the analyst, the semiconductor inventory correction cycle reached its bottom last year and demand in the PC market is improving as the inventory glut clears up. The inventory correction should lead to orders picking up next year, with chipmakers such as TSMC also benefiting from strong market demand for smartphones.

A key metric to watch for TSMC's upcoming earnings release is the firm's revenue. 2023 has been a strong year for the artificial intelligence industry, with NVIDIA in particular seeing strong stock market and industry interest in its GPUs. Since TSMC provides NVIDIA with a large number of products and initial worries about inadequate packaging facilities for the chips might take longer to materialize, the impact of NVIDIA's strong business on TSMC's earnings should make for an interesting reading.

According to the Taiwanese analyst, hype in the market for artificial intelligence is not new. He pointed out that 2016 saw considerable interest in analytical AI, which is used in applications such as facial, image and speech recognition. The recent trend is for generative AI, which sees models produce their own content as shown by the popularity of the chatbot ChatGPT.

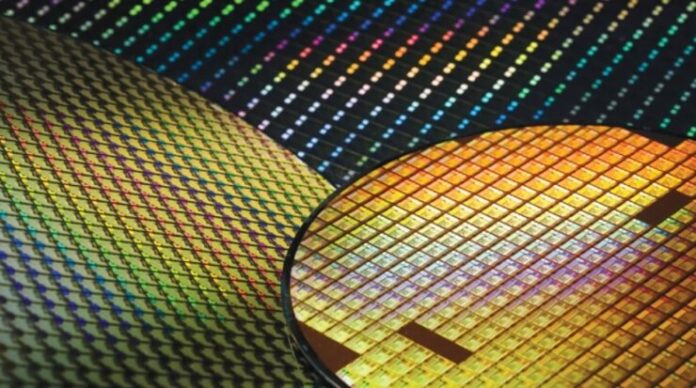

When it comes to catering to this fresh interest in AI, Taiwanese firms can target the hardware side of the industry. TSMC is one of the few companies in the world that can manufacture advanced chips in volume, and these chips form the background of training and operating AI models. Market estimates from the UDN show that global demand for AI server shipments this year will fall between 180,000 and 190,00 units. Out of this, Microsoft will account for nearly one third of the demand through buying roughly 50,000 units, while others such as Meta and Alphabet will procure 35,000 units and 25,000 units.

WccftechContinue reading/original-link]